How to Improve My Credit Score

How to Improve Your Credit Score Before Renting in 2025

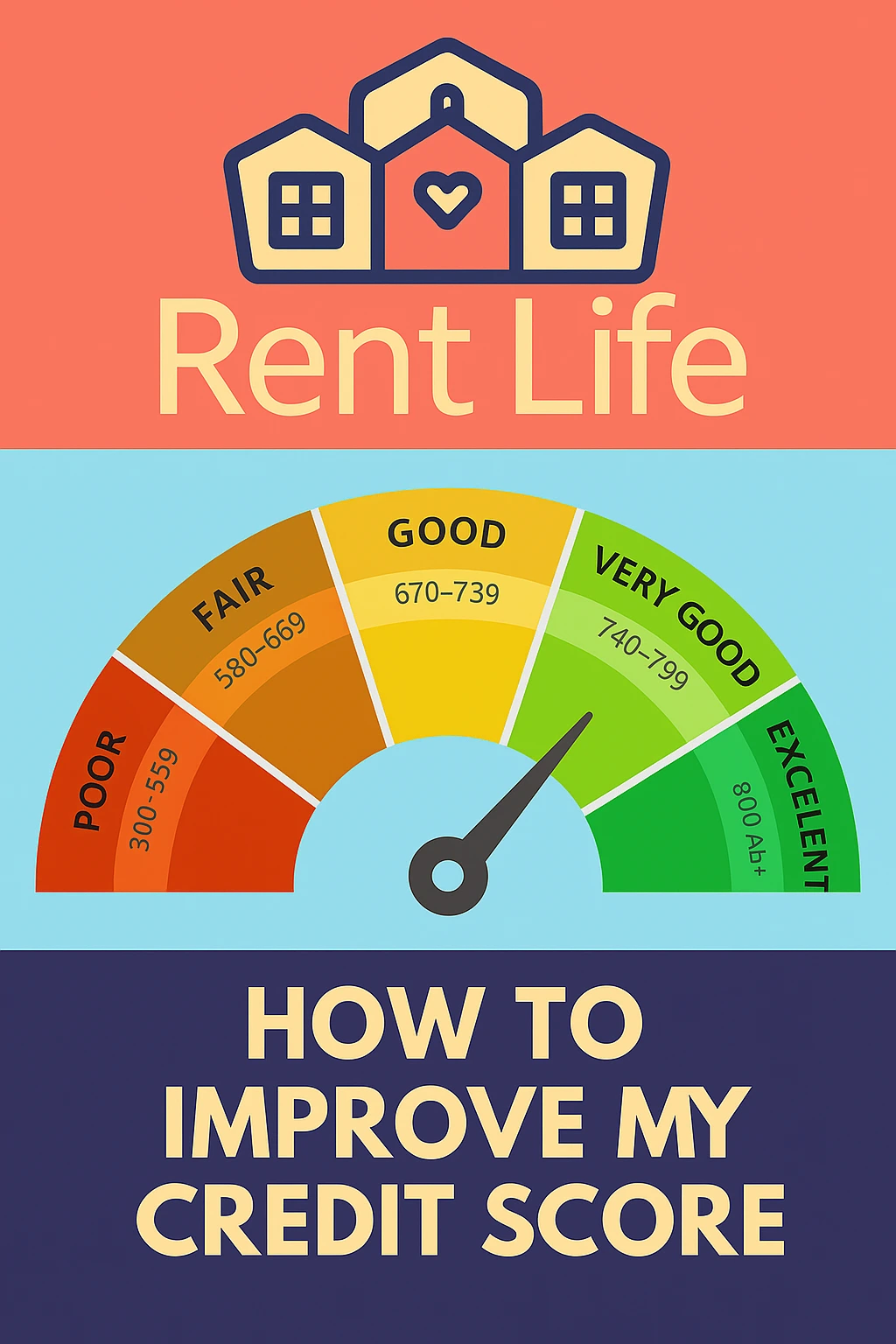

A strong credit score isn’t just about buying a home—it can be the key to unlocking your next rental. With rising demand in Canadian rental markets, landlords and property managers are increasingly using credit scores to screen tenants. If you’re looking to rent in 2025, it’s time to ask: Is your credit ready to work for you?

🧠 Why Credit Matters When Renting

Your credit score tells landlords how reliable you are with money. A high score means less risk—making it more likely you’ll secure the unit you want, at a better rate. Whether you’re applying in Toronto, Vancouver, or anywhere in between, improving your credit could be the deal-maker.

🔑 Key Strategies to Boost Your Credit Score

1. Pay On Time, Every Time

Your payment history is 35% of your score. Set reminders or automate payments for credit cards, bills, and loans. Even one missed payment can impact your score significantly.

2. Keep Credit Utilization Low

Use less than 30% of your available credit. For example, if your limit is $3,000, try to keep your balance under $900. High usage signals risk—even if you pay it off monthly.

3. Don’t Close Old Accounts

Length of credit history matters. Keep older cards open to show long-term, responsible borrowing—even if they’re rarely used.

4. Diversify Your Credit

A healthy credit mix (e.g., a student loan + credit card + secured credit card) shows you can manage multiple credit types responsibly.

5. Apply for Credit Cautiously

Avoid multiple hard inquiries in a short time. Lenders might see this as a red flag, even if you’re just shopping around.

💡 Use Rent to Build Credit

2025 is a breakthrough year—renters can now actively build credit with their monthly payments.

- Ask your landlord or property manager to report your on-time rent payments to major credit bureaus.

- Use third-party rent reporting platforms like Landlord Credit Bureau or RPM Champion.

- These tools let you earn credit for something you’re already doing—paying rent!

⚠️ Quick Wins & Pitfalls to Avoid

✅ Regularly check your credit report on Equifax or TransUnion

✅ Dispute any inaccuracies promptly

✅ Consider a credit-builder loan or secured credit card to establish or recover credit

🚫 Don’t max out credit cards

🚫 Don’t skip payments or let bills hit collections

🏠 Credit, Confidence & Renting with Rent Life

A great credit score can unlock premium rental listings and faster approvals on platforms like Rent-Life.ca, where tenants and landlords connect transparently. Plus, with tools like Duuo Insurance, you can protect your rental journey from day one.

Bottom Line:

Improving your credit before renting isn’t just smart—it’s strategic. Start now, rent better, and build a financial future you’re proud of.

#rentlife #rentlifeapp #forrent #rentals #renting #moving #movingtocanada #canada #canadalife #credit #creditscore

🔗 Resources to Improve Your Credit Score Before Renting (2025)

- liv.rent – How to Increase Your Credit Score

- Yahoo Finance – How to Improve Credit Score

- Bank of America – Better Money Habits

- Rates.ca – Rent Payments & Credit Scores in Canada

- RPM Fort Collins – Build Credit While Renting

- Equifax Canada – How to Build Credit

- RPM Champion – Rent Reporting for Credit Building

- Landlord Credit Bureau – Rent Can Increase Your Credit

- Wolfnest – Building Credit for Renters

- ABA – Improving Your Credit Score Tools